do nonprofits pay taxes on utilities

Sales to Government and Nonprofits. Individuals businesses and groups must pay use tax on their taxable purchases.

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Worksheet Template

They must pay payroll tax all sales and use tax and unrelated business income.

. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items. Do nonprofit organizations have to pay taxes. Enjoy flat rates with no-surprises.

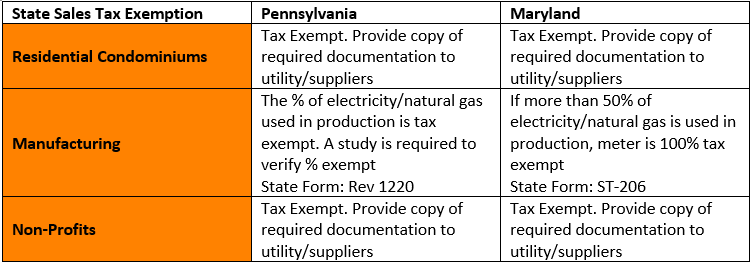

Effective February 2019 non-profit organizations and government agencies seeking a utility sales tax exemption should complete Form ST-109NPG and provide it directly to the utility. Most nonprofits fall into this category and enjoy numerous tax benefits. However this corporate status does not.

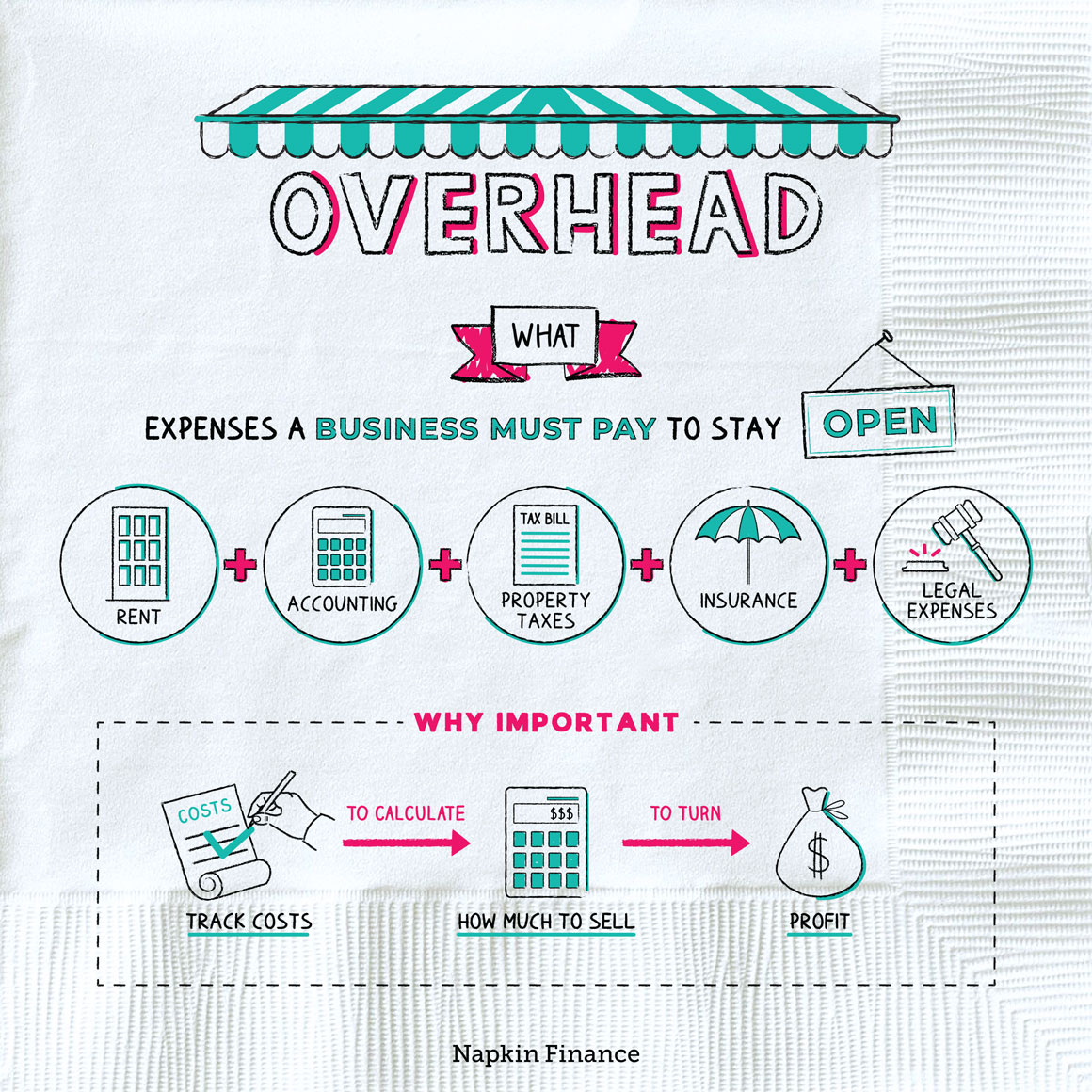

In most cases they wont owe income taxes at the. The state use tax is complementary to and mutually exclusive of the state sales tax. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. But nonprofits still have to pay.

The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. Nonprofits and churches arent completely off of Uncle Sams hook. The research to determine whether or not sales.

First and foremost they arent required to pay federal income taxes. Taxable if Income from any item given in exchange for a donation that costs the. We never bill hourly unlike brick-and-mortar CPAs.

Taxes Nonprofits DO Pay. Yes nonprofits must pay federal and state payroll taxes. Your recognition as a 501 c 3 organization exempts you from federal income tax.

However there are some situations where sales tax is not due. Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004. Federal and Texas government entities are automatically exempt.

Most sales of food and beverages to governments are taxable. Sadie is ready to get up to speed on paying payroll taxes. Property TaxRent Rebate Status.

Most nonprofits do not have to pay federal or state income taxes. Yet the parent Pepco Holdings did not pay income taxes during. Many but not all nonprofits are considered tax exempt which means that they are not required to pay federal corporate.

Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Wheres My Income Tax Refund.

However here are some factors to consider when. Pennsylvania Department of Revenue Tax Types Sales. But the one tax exemption that even nonprofits sometimes find.

Property taxes are typically levied by local governments so whether or not a nonprofit has to pay property taxes depends on the laws of the state and municipality in which. For assistance please contact any of the following Hodgson. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Tax Exemptions For Energy Nania

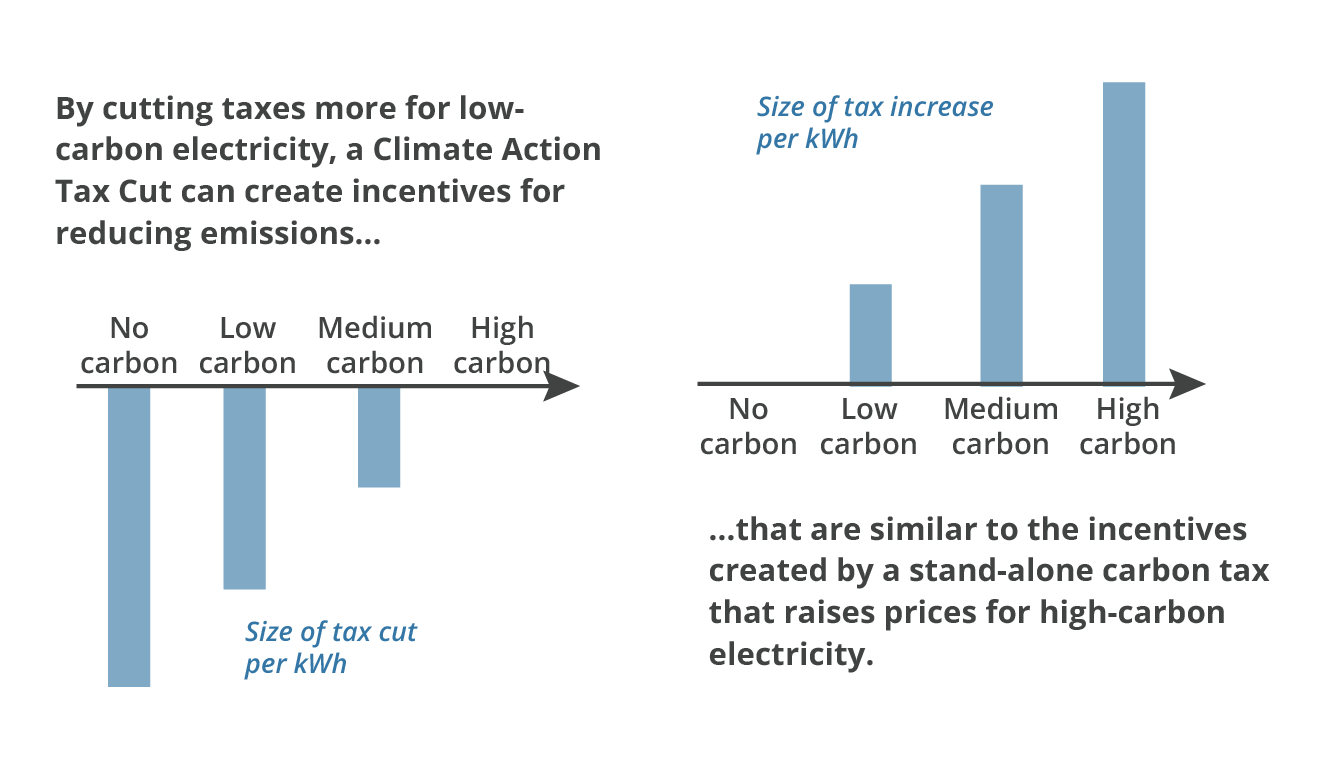

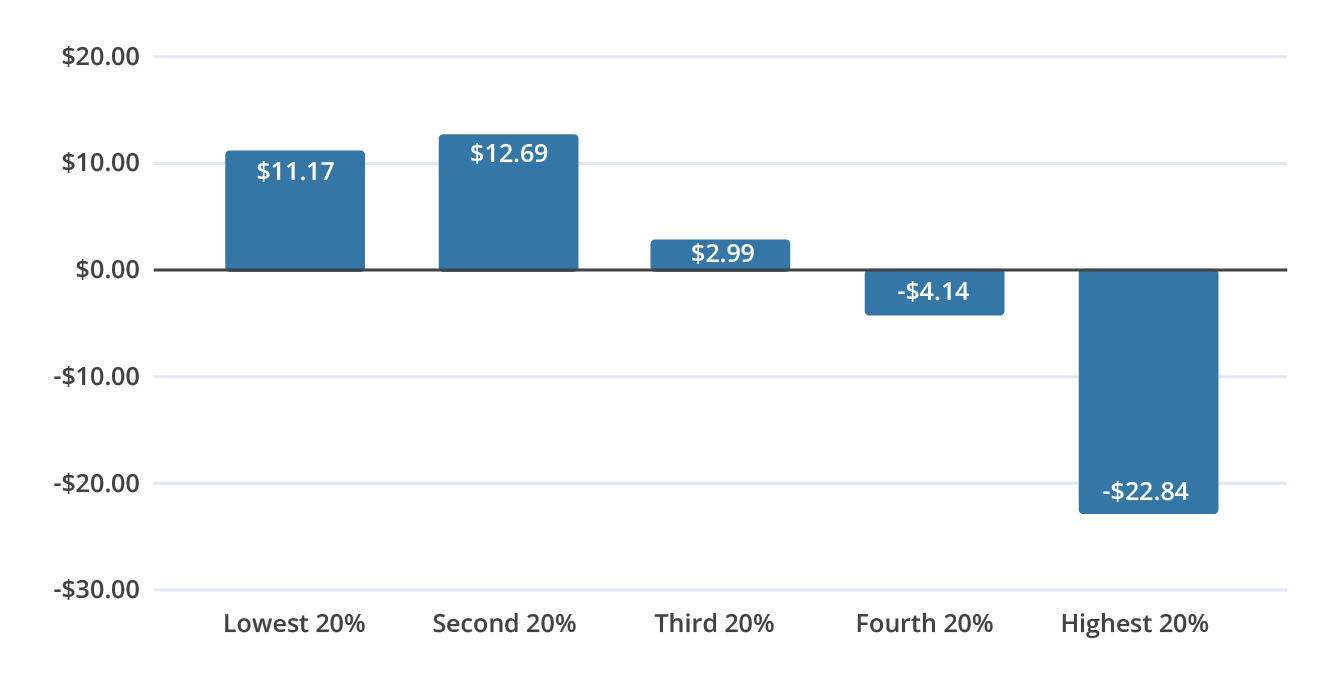

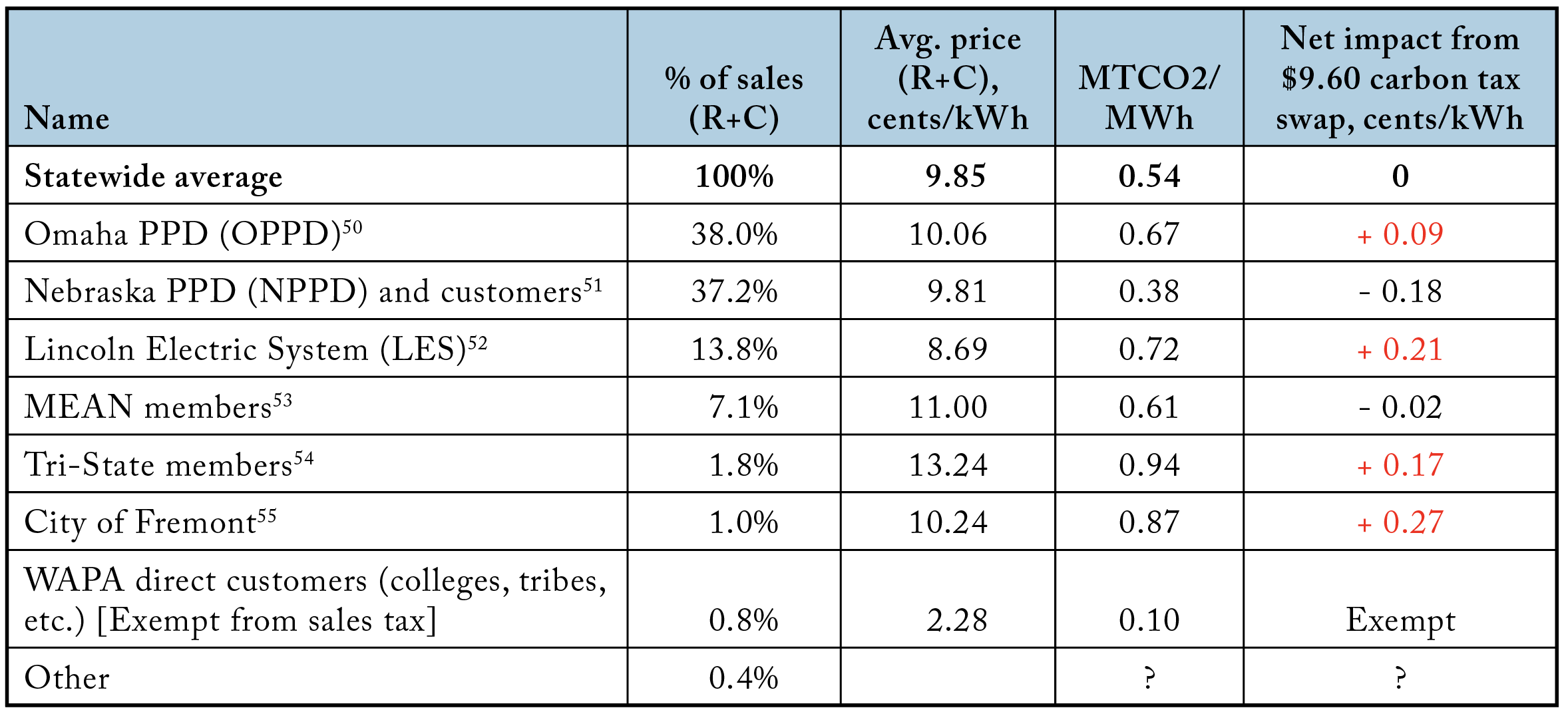

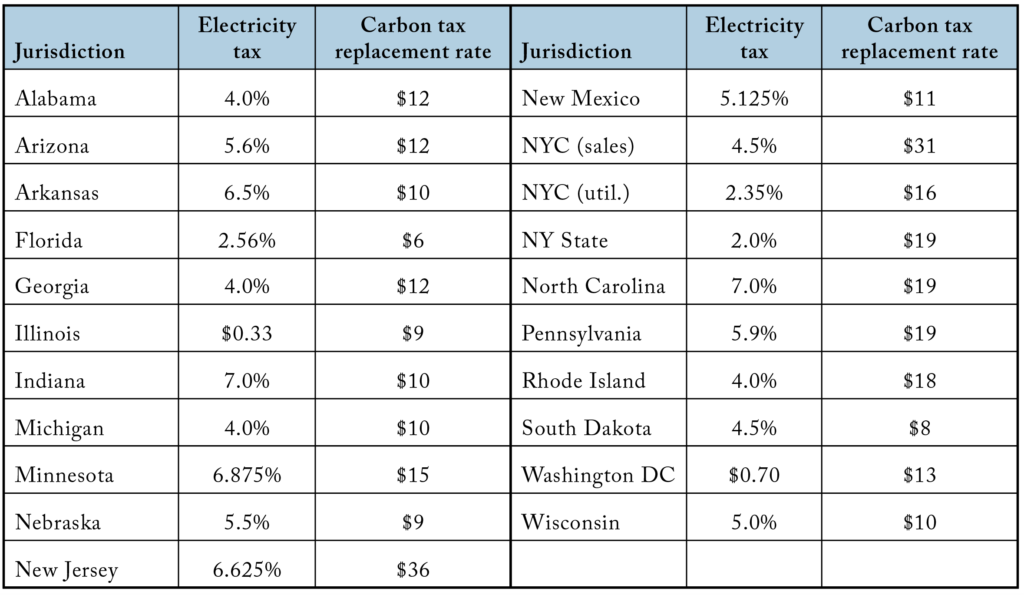

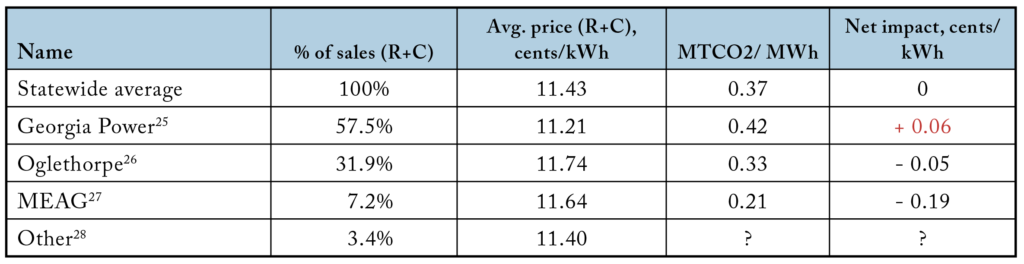

Carbon Taxes Without Tears The Cgo

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

What Utilities Should Consider When Evaluating Payment Kiosk Vendors Citybase

Carbon Taxes Without Tears The Cgo

Revenue Projection Spreadsheet Cash Flow Statement Cash Flow Spreadsheet Template

/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)

7 Things You Didn T Know Affect Your Credit Score

What Are Functional Expenses A Guide To Nonprofit Accounting

Providing Essential Utility Services During Covid 19 Payments And Relief

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Explanation Components And Examples

Tax Exemptions For Energy Nania

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo

Free Cash Flow Forecast Templates Smartsheet Cash Flow Free Cash Smartsheet

Carbon Taxes Without Tears The Cgo

Profit And Loss Template For Excel Profit And Loss Statement Statement Template Profit

:max_bytes(150000):strip_icc()/MarginalRateofSubstitution3-a96cfa584e1440f08949ad8ef50af09a.png)