tax rate in santa ana ca

The Treasurer-Tax Collectors Office is located in the Hall of Finance and Records at 12 Civic Center Plaza in Santa Ana CA on the ground floor Room G-58. 05 for Countywide Measure M Transportation Tax.

Santa Margarita CA Sales Tax Rate.

. Santa Ana CA Sales Tax Rate. You may pay your tax bill in person from 800-500 Monday thru Friday. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Santa Ana CA.

Santa Fe Springs CA Sales Tax Rate. The ordinance broadly defines cannabis business to include any for-profit or non-profit business that distributes delivers dispenses exchanges barters or sells either medical or non-medical cannabis and. The County sales tax rate is.

Some information relating to property taxes is provided below. You may pay your tax bill in person from 800-500 Monday thru Friday. Sales Tax in Santa Ana CA.

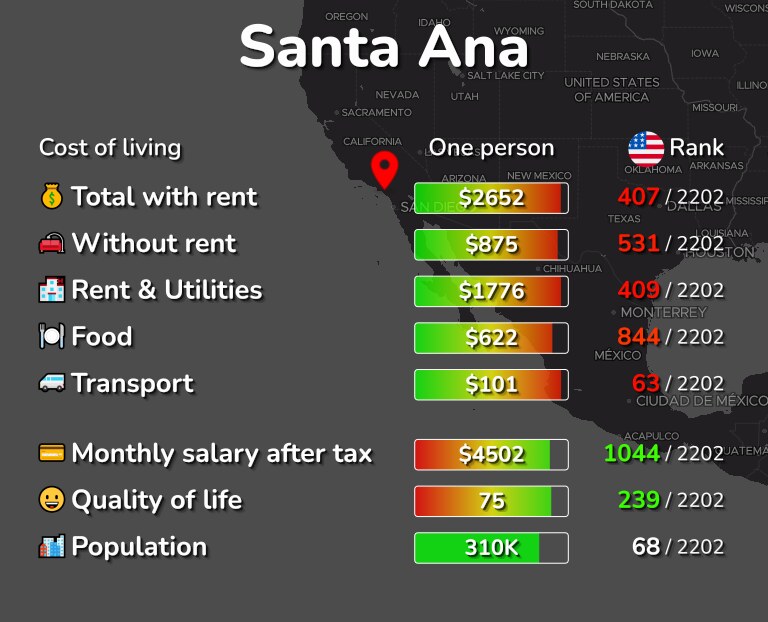

- The Median household income of a Santa Ana resident is 52519 a year. The California sales tax rate is currently. The US average is 46.

925 Highest in Orange County 725 for State Sales and Use Tax. - Tax Rates can have a big impact when Comparing Cost of Living. Orange County collects on average 056 of a propertys.

Sales Tax in Santa Ana CA. Santa Cruz CA Sales Tax Rate. The US average is 53482 a year.

20222023 Business License Tax Fee Schedule - Variable Flat Rate Tabla de Impuestos para Licencia Comercial 20222023 - Tarifa Fija Variable. Did South Dakota v. School District Bond Rate.

15 for Santa Ana Tax. The US average is 28555 a year. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years.

The Santa Ana sales tax rate is. The median home value in Santa Ana the county seat in Orange County is 455300 and. Libraries Parks and Recreation Who Do I Call.

Santa Clara CA Sales Tax Rate. 1788 rows Santa Ana 9250. - The average income of a Santa Ana resident is 16345 a year.

- The Income Tax Rate for Santa Ana is 93. Call me to find out the property tax on any home. The minimum combined 2022 sales tax rate for Santa Ana California is.

5 rows The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025. The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943. 4 rows Santa Ana CA Sales Tax Rate The current total local sales tax rate in Santa Ana CA is 9250.

Orange County Property Tax Rates Photo credit. There is a payment drop box at the main entrance of the building for your convenience. The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15 Special tax.

While the State of California only charges a 6 sales tax. Santa Clarita CA Sales Tax Rate. Keep in mind that under state law taxpayers can elicit a vote on proposed rate increases that exceed established limits.

The City of Santa Ana. Santa Ana must adhere to provisions of the California Constitution in levying tax. Income and Salaries for Santa Ana.

- The Median household income of a Santa Ana resident is 52519 a year. Santa Maria CA Sales Tax Rate. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Santa Ana CA.

The minimum combined 2022 sales tax rate for Santa Ana California is. Starting Monday Garden Grove Placentia and Seal Beach will see a 1-percent sales tax increase for a total of 875 percent while Santa Ana will see a 1 12-percent increase bringing its sales. Santa Monica CA Sales Tax Rate.

City of Santa Barbara 875 City of Santa Maria 875 SANTA CLARA COUNTY 9125 City of Campbell 9375 City of Los Gatos 925 City of Milpitas 9375 City of San Jose 9375 SANTA CRUZ COUNTY3 850 City of Capitola 900 City of Santa Cruz 925 City of Scotts Valley 975 City of Watsonville 925 Santa Cruz Unincorporated Area4 900 SHASTA. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The budgettax rate-determining process usually gives rise to customary public hearings to discuss tax rates and related budgetary questions.

Living in Santa Ana How to pay a bill. Santa Barbara CA Sales Tax Rate. You are advised to do your own research regarding property tax rates in Orange County CA and to also check for special assessments such as additional fees Mello Roos etc.

Income and Salaries for Santa Ana - The average income of a Santa Ana resident is 16345 a year. This is the total of state county and city sales tax rates. What is the sales tax rate in Santa Ana California.

Shall Chapter 21 of the Santa Ana Municipal Code be amended to enact both a gross square footage tax of between 25 cents to 3500 and a gross receipts tax rate up to 10 for cultivating manufacturing distributing selling or testing cannabis and related products to raise between 8 to 12 million to fund public safety parks youth and senior services among. Santa Cruz County There is a tax tax with a maximum tax rate of 10 of gross receipts but sets the initial tax rate at 7. Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499.

20 Civic Center Plaza Santa AnaCA 92701 714 647-5400.

Measure X The City Of Santa Ana

Who Pays The Transfer Tax In Orange County California

Sales Tax In Orange County Enjoy Oc

New Homes For Sale In Irvine California C2e Model Grand Opening Saturday April 21 10am Floorplans A Urban Boutique New Homes For Sale John Wayne Airport

View Of Fourth Street In Santa Ana Looking West From North Main Street 1945 California Historical Soci California History Santa Ana San Luis Obispo County

Cost Of Living In Santa Ana Ca Rent Food Transport

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Penaloza Insurance Services Offers A Wide Range Of Best Tax Preparation For Small Business Owners And Best Income Tax Servi Taxact Tax Preparation Tax Services

Food And Sales Tax 2020 In California Heather

Santa Ana Winds Through The Orange Groves Flickr Photo Sharing San Bernardino Mountains Redlands San Bernardino County

The California Gas Tax Rate Is About 70 Cents A New California Gas Tax Increase Took Effect On July 1 2021 As Part Of Annual Infla In 2022 Gas Tax Gas Gas Calculator

Orange County Property Tax Oc Tax Collector Tax Specialists

184 Sandcastle Home For Sale In Aliso Viejo Danny Murphy Associates Aliso Viejo California Real Estate Sand Castle

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Proposal From Gop Lawmakers Would Cut California Gas Tax For Six Months Orange County Register

Ha Ha The Tax Form We Wish Existed Tax Forms Funny Lists I Love To Laugh